Gold has been a symbol of wealth and stability for centuries, and today it remains a popular investment choice. Among the various forms of gold investment, bullion bars stand out due to their simplicity, purity, and value. This article explores the key aspects of investing in bullion bars , focusing on the benefits, considerations, and steps to make an informed investment.

What Are Bullion Bars?

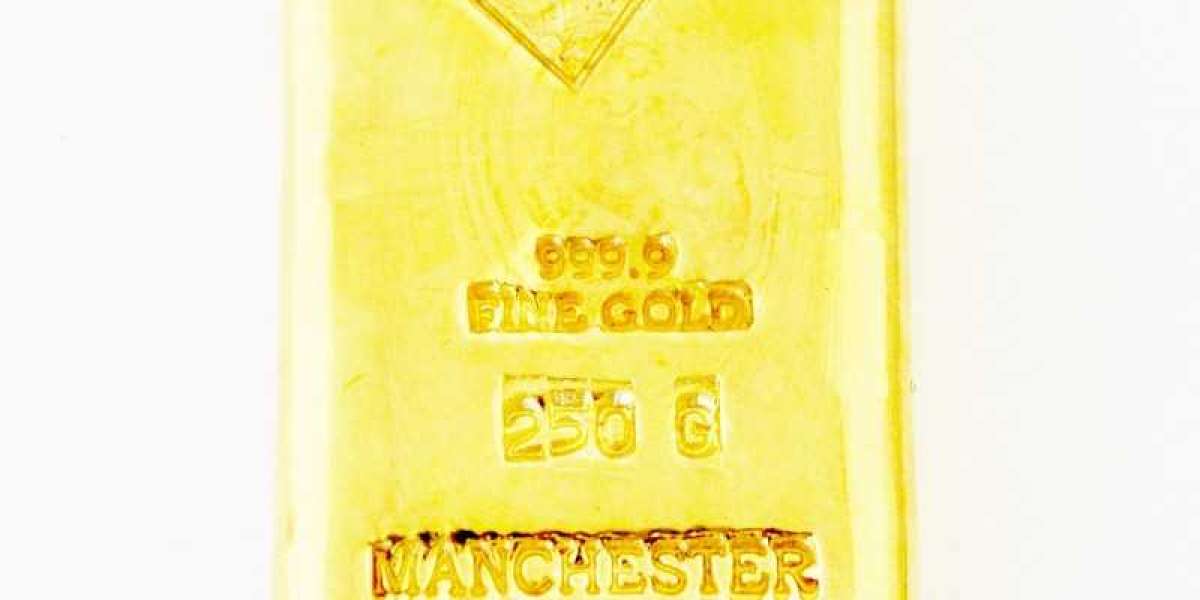

Bullion bars, often referred to simply as gold bars, are rectangular blocks of gold that are manufactured to precise specifications of weight and purity. They are available in a range of sizes, from small 1-gram bars to large 400-ounce bars, and are typically composed of 99.99% pure gold (24 karats).

Benefits of Investing in Bullion Bars

- High Purity: Bullion bars are usually made from 99.99% pure gold, ensuring that you are getting a high-value asset.

- Wealth Preservation: Gold has historically been a reliable store of value, maintaining its purchasing power over time and protecting against inflation and economic instability.

- Liquidity: Bullion bars are highly liquid and can be easily bought and sold in global markets. Their standard sizes and recognized purity make them widely accepted.

- Lower Premiums: Compared to gold coins, bullion bars often have lower premiums over the spot price of gold, making them a cost-effective option for investors.

- Diversification: Including gold bullion bars in your investment portfolio can help diversify your assets, reducing overall risk and volatility.

Considerations When Buying Bullion Bars

- Purity and Certification: Ensure that the bullion bars you purchase come with a certificate of authenticity and are stamped with details such as weight, purity, and the manufacturer’s mark.

- Reputable Dealer: Buy from established and trusted dealers who offer guarantees of authenticity and transparent pricing. Research customer reviews and ratings to ensure reliability.

- Size and Weight: Choose the size and weight of the bullion bars based on your investment goals and budget. Smaller bars are more affordable and easier to sell, while larger bars offer better value per gram.

- Storage: Proper storage is essential to protect your investment. Consider secure storage options such as safety deposit boxes, professional vaults, or home safes designed for precious metals.

- Market Timing: Stay informed about current gold market trends and prices. While it’s challenging to time the market perfectly, understanding the broader economic context can help you make informed decisions.

Where to Buy Bullion Bars

- Online Dealers: Many reputable online dealers specialize in gold bullion and offer a wide range of bullion bars. Look for dealers with strong reputations, secure payment methods, and insured shipping options.

- Local Dealers: Local bullion dealers and coin shops can be good sources for purchasing bullion bars. Visiting in person allows you to inspect the bar before purchasing and can sometimes provide better deals.

- Banks: Some banks offer bullion bars for sale, particularly in regions where gold investment is common. Check with your local bank for availability and purchase terms.

- Bullion Exchanges: Specialized bullion exchanges offer competitive prices and a variety of bullion bars. Ensure they are reputable and provide certification for their products.

Steps to Buy Bullion Bars

- Research: Start with thorough research on bullion bars, including current market prices, reputable dealers, and storage options.

- Set a Budget: Determine your investment budget, bullion bars considering both the price of gold and additional costs such as premiums and storage.

- Choose a Dealer: Select a dealer based on their reputation, customer feedback, and the authenticity guarantees they offer.

- Verify Authenticity: Ensure the bar comes with a certificate of authenticity and features proper markings of purity and weight.

- Secure Payment and Delivery: Use secure payment methods and ensure that the delivery is insured and requires a signature upon receipt.

- Store Safely: Once acquired, store your bullion bars in a secure location to protect your investment.

Conclusion

Investing in bullion bars is a prudent way to preserve wealth, hedge against inflation, and diversify your investment portfolio. With their high purity, intrinsic value, and global recognition, bullion bars offer a reliable and straightforward investment option. By understanding the key considerations and taking informed steps, you can make confident decisions that will benefit your financial future. Whether you are a new or experienced investor, bullion bars can be a valuable addition to your investment strategy.