In addition, employee loans can foster a positive workplace environment. When employees really feel supported throughout monetary hardships, they are more likely to stay dedicated and productive.

In addition, employee loans can foster a positive workplace environment. When employees really feel supported throughout monetary hardships, they are more likely to stay dedicated and productive. This side can immediately improve general employee morale and scale back turnover charges, providing a win-win situation for each part

In some cases, debtors could not fully comprehend the fees that will arise, such as money advance charges or service expenses associated to the mortgage. Therefore, it is vital to thoroughly learn the phrases and circumstances associated with any Card Holder L

How to Apply for a Card Holder

Same Day Loan The application course of for a Card Holder Loan varies by lender but generally includes assessing the available stability in your bank card. Most credit card issuers present online facilities the place you can examine your available credit and request cash advan

Lastly, daily loans can serve as a monetary tool to help manage money circulate gaps between paychecks, offered they're utilized responsibly. They can bridge the gap in times of want when different monetary resources are not availa

Application Process for Emergency Fund Loans

The software course of for an emergency fund mortgage sometimes involves a quantity of easy steps. The first step is gathering related documentation, such as proof of revenue, identification, and some other needed monetary data. Having these documents ready can streamline the application proc

Advantages of Employee Loans

One of the first advantages of worker loans is the **accessibility** they offer. Many employees might face financial challenges that conventional banks are reluctant to accommodate. Due to the inherent belief between employers and workers, companies typically have extra versatile lending requirements and a quicker approval course

In addition to evaluations and comparisons, BePick presents insights into borrower experiences and suggestions for managing credit wisely. This dedication to education and transparency equips users with the knowledge they should navigate the often-complex world of loans successfu

The journey to understanding **delinquent loans** would not have to be solitary. With sources like BePick, debtors can equip themselves with data and assist, enabling them to handle their loans confidently and scale back the danger of falling into delinque

Using Loans Responsibly

While emergency fund loans serve a valuable objective, it is important to use them responsibly. Borrowers should only take out a loan if actually needed and may all the time have a reimbursement plan in place. This foresight may help mitigate monetary pressure during reimbursem

n To ensure timely repayment, debtors should create a budget that accounts for the month-to-month mortgage cost. Setting up automatic funds can even help prevent missed deadlines. It's advisable to communicate with the lender if financial difficulties come up, as they might supply solutions to avoid default

Furthermore, fostering monetary literacy is an ongoing journey. Engaging with monetary content material, attending workshops, or seeking advice from certified financial advisors can considerably improve a borrower’s capacity to navigate the complexities of loans and credit sc

How to Effectively Use Employee Loans

To utilize an employee mortgage effectively, it’s essential to assess your monetary scenario totally. Before making use of, contemplate whether the quantity requested aligns with the bills you face. Creating a price range may help make clear your wants and whether the mortgage is a necessity or a convenie

Approval timelines can vary relying on the lender and type of mortgage. Traditional banks might take a number of weeks to course of applications, while online lenders can usually provide approval inside 24 hours. Factors like documentation readiness and business

Credit Loan score historical past may also affect the velocity of appro

Furthermore, BePick includes a

이지론 group forum where customers can share experiences and recommendation associated to delinquency and mortgage management. This collaborative setting fosters learning and encourages debtors to seek help from peers who may have faced comparable challen

Understanding Daily Loans Daily loans, sometimes called short-term loans or payday loans, are designed to provide fast access to funds, sometimes to cowl bills till the next paycheck. These loans are characterized by their brief reimbursement periods, usually spanning from a few days to a mo

Lines of credit offer flexibility, allowing companies to borrow up to a sure limit and pay interest only on the quantity drawn. This is good for managing money flow and dealing with unexpected bills. On the opposite hand, SBA loans are government-backed loans with decrease rates of interest designed for small companies who may not qualify for traditional financ

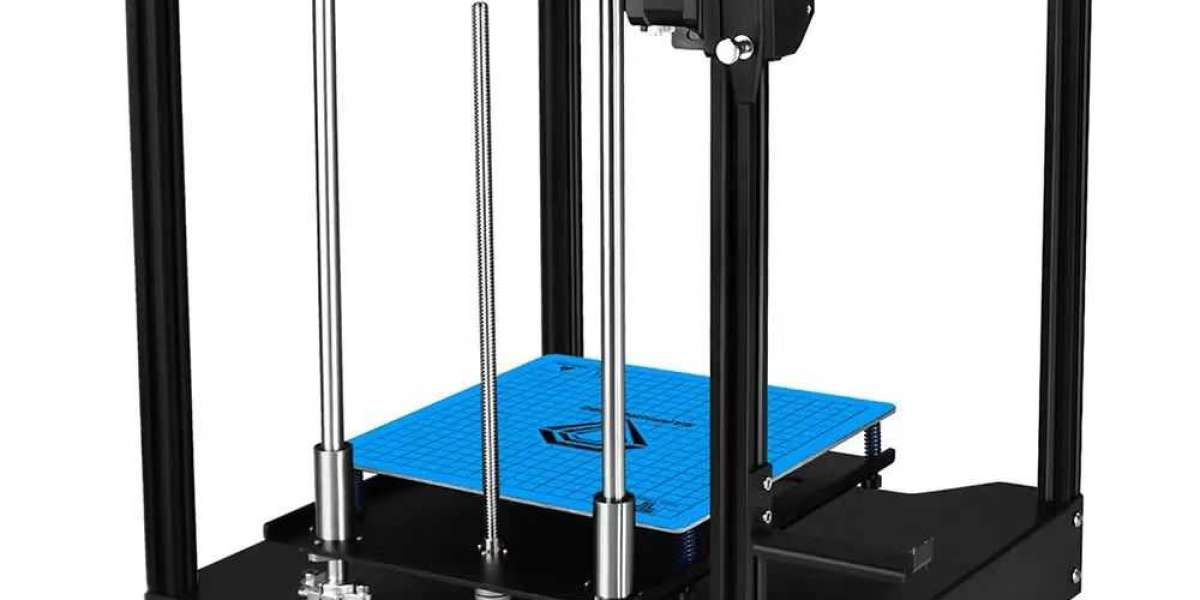

Buy 3D Printers Online: Explore Cutting-Edge Technology at WOL3D Coimbatore

Buy 3D Printers Online: Explore Cutting-Edge Technology at WOL3D Coimbatore

The Phenomenon of PK Batch Air Jordan: A Deep Dive into Sneaker Culture and Replicas in the American Market

The Phenomenon of PK Batch Air Jordan: A Deep Dive into Sneaker Culture and Replicas in the American Market

Is This What You Are Longing To See Regarding THC Vapes?

Is This What You Are Longing To See Regarding THC Vapes?

Is it possible to grow picked blooms in Animal Crossing? No.

Is it possible to grow picked blooms in Animal Crossing? No.

3D Pens Near Me: Buy Top 3D Pens from WOL3D Coimbatore

3D Pens Near Me: Buy Top 3D Pens from WOL3D Coimbatore