Furthermore, Day Laborer Loans may help individuals construct a positive credit history, provided they are repaid responsibly.

Furthermore, Day Laborer Loans may help individuals construct a positive credit history, provided they are repaid responsibly. By making well timed funds, debtors can enhance their credit scores, allowing for higher phrases on future loans or financing choi

Risks Involved with No-document Loans

While No-document Loans provide unmistakable advantages, they inherently come with risks. Most notably, these loans sometimes have higher rates of interest compared to conventional loans. Since lenders have much less data to mitigate their danger, they may cost more to offset potential los

Benefits of Day Laborer Loans

Day Laborer Loans present quite a few advantages for those engaged in informal work. One major benefit is speed; purposes can often be accomplished on-line inside a matter of minutes, with funds disbursed shortly thereafter. This fast turnaround is important for day laborers who may not have the luxurious of ready for traditional

Additional Loan processing ti

n Eligibility necessities for no-document loans can vary extensively among lenders. Typically, debtors should show good creditworthiness, albeit without having intensive revenue verification. Factors corresponding to credit rating, existing debt, and mortgage amount play a big function in determining eligibility. It's advisable to examine the particular phrases set by each len

If you discover yourself unable to repay your emergency mortgage on time, the first step is to contact your lender. Many lenders provide choices such as fee extensions, revised

Loan for Unemployed phrases, or restructuring. Communicating transparently together with your lender may help you navigate a tricky situation without incurring extreme penalt

Eligibility Criteria for Borrowing

While the eligibility necessities for Day Laborer Loans are generally much less stringent than those of traditional loans, they'll vary by lender. Commonly, lenders could evaluate elements corresponding to income level and repayment ability, rather than focusing exclusively on credit scores. Some lenders may require proof of revenue, such as pay stubs or bank statements, even for day labor

Daily loans have gained important reputation over latest years due to the fast-paced nature of recent life. Consumers usually find themselves in conditions the place conventional banking services don't meet their pressing financial wants. As a outcome, daily loan providers have emerged, creating a niche that caters particularly to this demand. The accessibility of these loans has helped many avoid the potential pitfalls of delayed payments and the following charges that may arise from t

Another important benefit is the accessibility of those loans. Many lenders cater to individuals with out robust credit score histories, ensuring that even these with restricted financial backgrounds have opportunities for borrowing. This inclusivity enables day laborers to secure funds that would in any other case be unavailable to them in traditional banking situati

Bepick: Your No-document Loan Resource

Bepick provides a wealth of information and resources regarding no-document loans, making it a wonderful place to begin for these exploring

i loved this financing choice. Users can access complete guides, detailed evaluations, and comparisons to make knowledgeable decisions of their borrowing journ

Unlike conventional loans, emergency loans typically have a streamlined approval course of, which reduces paperwork and time concerned. This accessibility, nevertheless, comes with numerous terms and interest rates that may vary considerably among lenders. It's important to assess the budget and repayment capabilities earlier than continuing with an emergency mortg

Understanding No-document Loans

No-document loans, also known as "no-doc" loans, permit borrowers to secure financing with out submitting extensive documentation, similar to income statements, tax returns, or employment verifications. These loans cater to people who may have bother offering commonplace documentation because of self-employment, irregular income streams, or these trying to expedite the borrowing process. The ease of acquiring no-document loans could be advantageous, especially in time-sensitive conditi

While no-document loans streamline monetary entry, they also come with unique lending criteria. Generally, lenders offering these loans assess a borrower’s credit history and general creditworthiness somewhat than relying on conventional documentation. This method can result in faster mortgage approval processes, permitting borrowers to entry funds more rapidly and effectiv

Where to Find Comprehensive Information

For these looking for extra detailed data on Day Laborer Loans, BePick is a superb useful resource. This platform provides extensive articles, guides, and reviews regarding varied financial merchandise tailor-made to day laborers. BePick's goal is to provide customers with the data they need to make informed financial selecti

Buy 3D Printers Online: Explore Cutting-Edge Technology at WOL3D Coimbatore

Buy 3D Printers Online: Explore Cutting-Edge Technology at WOL3D Coimbatore

The Phenomenon of PK Batch Air Jordan: A Deep Dive into Sneaker Culture and Replicas in the American Market

The Phenomenon of PK Batch Air Jordan: A Deep Dive into Sneaker Culture and Replicas in the American Market

Is This What You Are Longing To See Regarding THC Vapes?

Is This What You Are Longing To See Regarding THC Vapes?

Is it possible to grow picked blooms in Animal Crossing? No.

Is it possible to grow picked blooms in Animal Crossing? No.

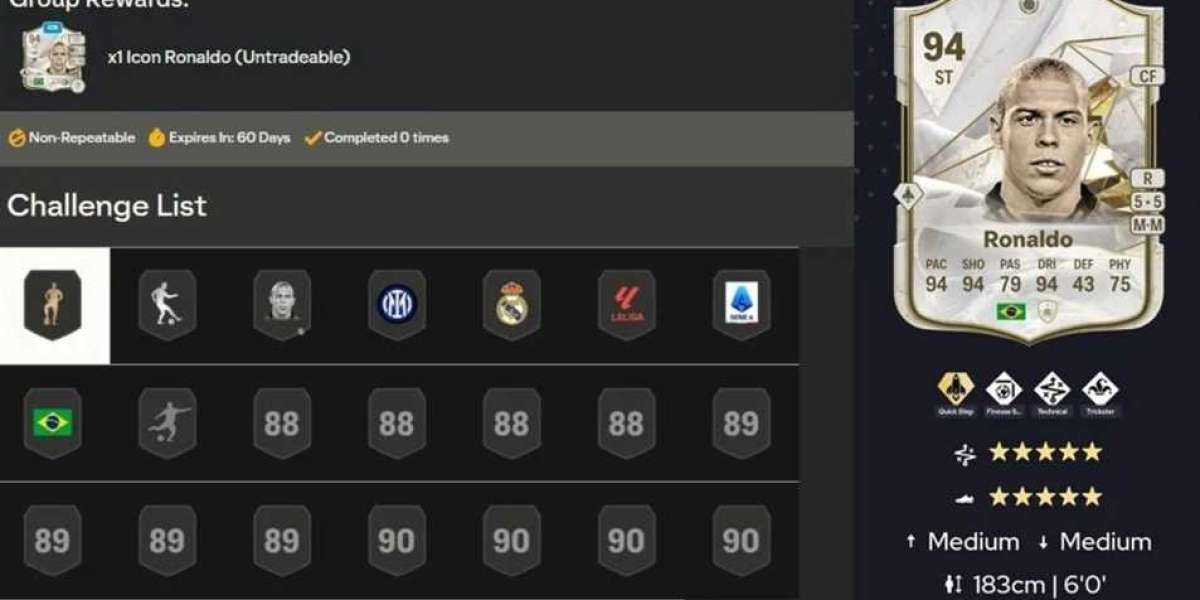

Cristiano Ronaldo Aims to Retire at 41 After 2026 World Cup

Cristiano Ronaldo Aims to Retire at 41 After 2026 World Cup